- WELL expects1 to announce strong financial results for Q3-2022 with another record for omni-channel patient visits and interactions which will lead to another record revenue performance.

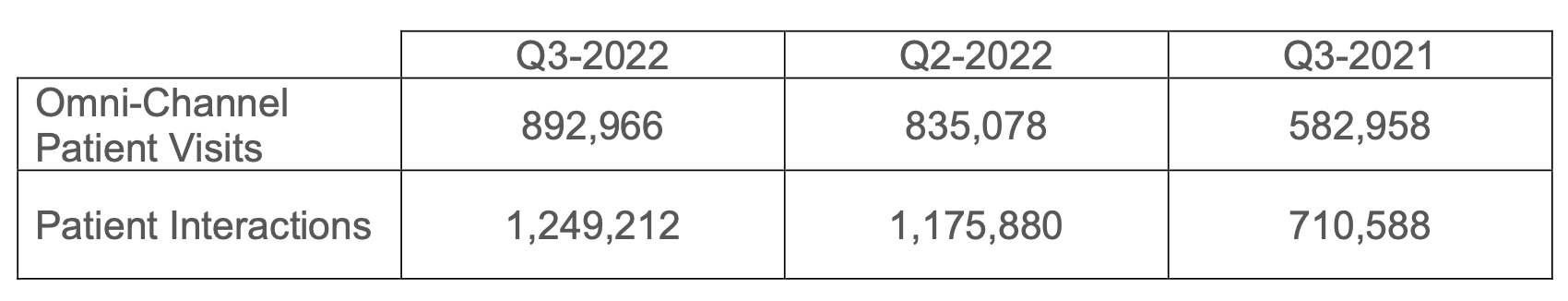

- Total omni-channel patient visits2 in Q3-2022 increased by approximately 53% when compared to Q3-2021. The Company also achieved an annualized run-rate of ~5.0 million patient interactions.

- WELL continues to successfully allocate capital and complete highly accretive tuck-in acquisitions in both Canada and the US. Today it completed the acquisition of various Canadian EMR, Billing and Clinical assets from CloudMD Software & Services Inc. (“CloudMD”).

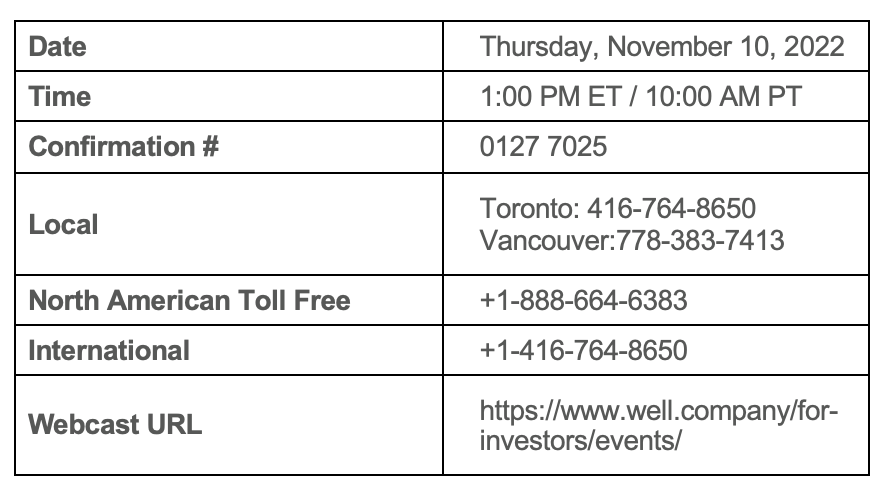

- WELL will disclose its financial results and host its Q3-2022 earnings conference call on Thursday November 10, 2022.

Vancouver, BC, November 2, 2022 /PRNewswire/ – WELL Health Technologies Corp. (TSX: WELL, OTCQX: WHTCF) (“WELL” or the “Company“), a digital health company focused on positively impacting health outcomes by leveraging technology to empower healthcare practitioners and their patients globally, is pleased to provide a preview of the volume of its patient visit and interactions in Q3-2022.

WELL expects1 to report strong financial results underpinned by significant growth in patient visits. WELL achieved a total of 892,966 omni-channel patient visits2 in Q3-2022, representing a year-over-year increase of 53% compared to Q3-2021, and a 7% increase compared to Q2-2022. In addition, MyHealth conducted 169,294 diagnostic visits in Q3-2022, while Wisp completed 186,952 asynchronous patient consultations. Combining WELL’s omni-channel patient visits2, MyHealth’s diagnostic visits and Wisp’s asynchronous patient consultations, WELL achieved a total of 1,249,212 patient interactions in Q3-2022, representing an annualized run-rate of 5.0 million patient interactions.

“We’re very pleased to report another record quarter of patient visits and interactions mainly delivered by our more than 2,300 healthcare provider partners systemwide,” said Hamed Shahbazi, Chairman and CEO of WELL. “WELL’s business model is simple and effective because it is laser focused on supporting and tech-enabling the healthcare providers that form the bedrock of our healthcare ecosystem. Our solutions help care providers with all aspects of their business including front and back-office solutions so that they can focus on patient care and not administrative burdens and deliver improved patient outcomes. Healthcare workers continue to face significant challenges as we transition to a post-pandemic world, and WELL is applying all its talents and resources to support them. WELL’s business not only continues to reflect the strength and resilience associated with the healthcare industry, but we’ve also demonstrated that when care providers are supported well, their practices flourish. Our industry leading organic growth is showing our model of ‘caring for the car providers’ is working.”

Eva Fong, CFO of WELL, commented, “Our strong Q3 patient visits and interactions were driven by healthy growth in our US-based virtual services businesses, Circle Medical and Wisp, which now exceed an annual revenue run-rate of US$100M on a combined basis, reflecting 124% YoY organic growth and are operating profitably on an Adjusted EBITDA3 basis. In addition, Q3 patient visits and interaction metrics were positively impacted by the onboarding of new practitioners onto our platform and the closing of the Inliv acquisition. We look forward to reporting Q3 results.”

Completion of asset acquisition from CloudMD

WELL is pleased to announce that it has closed the previously announced acquisition of various Canadian EMR, billing and clinical assets from CloudMD for approximately $5.7 million paid in cash, subject to post-closing adjustments and holdbacks. WELL reaffirms its expectation that the assets will operate profitably while contributing more than $9M in topline revenues. This transaction reflects WELL’s disciplined capital allocation strategy and continued expansion in the Canadian healthcare service and healthcare IT space. Integration of the newly acquired assets will begin immediately.

Q3 Earnings Release and Conference Call

WELL will release its Third Quarter 2022 financial results for the period ended September 30, 2022, on Thursday, November 10, 2022. The Company will hold a conference call and simultaneous webcast to discuss its results on the same day at 1:00 pm EST (10:00 am PST). The call will be hosted by Hamed Shahbazi, Chairman and Chief Executive Officer and Eva Fong, Chief Financial Officer. Please dial in 10 minutes prior to the start of the call.

Conference Call Participant Details

Footnotes:

- Expectations noted are based on preliminary results recorded to date. These results may be subject to change as they are prepared for financial disclosure.

- Omni-channel patient visits is defined by all patient visits generated by all sources and channels. This includes any patient visits delivered by a WELL healthcare practitioner (inclusive of in-person or virtual) or a non-WELL practitioner but facilitated by WELL’s virtual care tools. This figure does not include visits for diagnostic testing consultations or any asynchronous physician consultations.

- Non-GAAP financial measure. Earnings before interest, taxes, depreciation, and amortization (“EBITDA”) and Adjusted EBITDA should not be construed as alternatives to net income/loss determined in accordance with IFRS. EBITDA and Adjusted EBITDA do not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. The Company defines Adjusted EBITDA as EBITDA (i) less net rent expense on premise leases considered to be finance leases under IFRS and (ii) before transaction, restructuring, and integration costs, time-based earn-out expense, change in fair value of investments, share of loss of associates, foreign exchange gain/loss, and stock-based compensation expense, and (iii) Revenue precluded from recognition under IFRS 15 that relates to certain patient services revenue that the Company believes should be recognized as revenue based on its contractual relationships. The Company considers Adjusted EBITDA a financial metric that measures cash that the Company can use to fund working capital requirements, service future interest and principal debt repayments and fund future growth initiatives.

WELL HEALTH TECHNOLOGIES CORP.

Per: “Hamed Shahbazi”

Hamed Shahbazi

Chief Executive Officer, Chairman and Director

About WELL Health Technologies Corp.

WELL is a practitioner focused digital healthcare company whose overarching objective is to positively impact health outcomes to empower and support healthcare practitioners and their patients. WELL has built an innovative practitioner enablement platform that includes comprehensive end to end practice management tools inclusive of virtual care and digital patient engagement capabilities as well as Electronic Medical Records (EMR), Revenue Cycle Management (RCM) and data protection services. WELL uses this platform to power healthcare practitioners both inside and outside of WELL’s own omni-channel patient services offerings. As such, WELL owns and operates Canada’s largest network of outpatient medical clinics serving primary and specialized healthcare services and is the provider of a leading multi-national, multi-disciplinary telehealth offering. WELL is publicly traded on the Toronto Stock Exchange under the symbol “WELL” and on OTCQX under the symbol “WHTCF”. To learn more about the Company, please visit: www.well.company.

Forward-Looking Information

This news release may contain “Forward-Looking Information” within the meaning of applicable Canadian securities laws, including without limitation WELL’s expectations to report strong financial results. Forward-Looking Information is based upon several estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, and contingencies. Forward-Looking Information generally can be identified by the use of forward-looking words such as “may”, “should”, “will”, “could”, “intend”, “estimate”, “plan”, “anticipate”, “expect”, “believe” or “continue”, or the negative thereof or similar variations. Forward-looking Information involves known and unknown risks, uncertainties and other factors that may cause future results, performance, or achievements to be materially different from the estimated future results, performance or achievements expressed or implied by such Forward Looking Information and, which are not guarantees of future performance. WELL’s statements expressed or implied by Forward Looking Information are subject to several risks, uncertainties, and conditions, many of which are outside of WELL ‘s control, and undue reliance should not be placed on such statements. Forward-Looking Information is qualified in their entirety by inherent risks and uncertainties, including: direct and indirect material adverse effects from the COVID-19 pandemic; adverse market conditions; risks inherent in the primary healthcare sector in general; regulatory and legislative changes; that future results may vary from historical results; inability to obtain any requisite future financing on suitable terms; any inability to realize the expected benefits and synergies of acquisitions; that market competition may affect the business, results and financial condition of WELL and other risk factors identified in documents filed by WELL under its profile at www.sedar.com, including its most recent Annual Information Form. Except as required by securities law, WELL does not assume any obligation to update or revise any forward-looking information, whether as a result of new information, events or otherwise.

For further information

Tyler Baba

Investor Relations Manager

investor@well.company

604-628-7266